Introduction to Mobile Payment Solutions

Mobile payment solutions have emerged as a game-changer in the realm of financial transactions. It is revolutionizing the way we make payments and conduct business. Prevalence of Smartphones and the rapid growth of digital technologies are increasing. And it makes mobile payment solutions as an integral part of our daily lives. In this section, let us delve into the definition and significance of mobile payment solutions. And also, let us explore their impact on the digital economy.

Mobile payment solutions are the technology and infrastructure enabling individuals and businesses to make financial transactions using Smartphones and Tablets. These solutions leverage various technologies like near-field communication or NFC, QR codes, and mobile wallet applications. It is to facilitate secure and convenient payment processes.

Importance of Mobile Payment Solutions

The importance of mobile payment solutions stems from their ability to offer unparalleled convenience and accessibility. In a world where people are constantly moving, carrying cash or credit cards is no longer necessary. With mobile payment solutions, individuals can make transactions anytime, anywhere, simply by using their Smartphones. It is very useful in paying for goods and services at a physical store. And, it is very helpful in transferring money to friends and family, or making online purchases. Mobile payment solutions have made financial transactions more streamlined and effortless.

Integration

Mobile payment solutions have significantly impacted the digital economy by driving the growth of e-commerce and digital transactions. Online shopping continues to gain popularity. Further, consumers increasingly expect seamless and secure payment options. Mobile payment solutions have addressed this demand. It provides a fast and efficient way to complete transactions in the digital realm. They have become a crucial component of online shopping platforms. And it allows users to make purchases with just a few taps on their mobile devices.

For businesses, integrating mobile payment solutions into their operations has become essential for staying competitive in the digital landscape. By offering mobile payment options, companies can enhance customer experiences. And they can attract tech-savvy consumers and drive sales. Additionally, mobile payment solutions often come with built-in loyalty and rewards programs. And that is providing businesses with valuable insights into consumer behavior and fostering customer engagement.

The widespread adoption of mobile payment solutions has transformed how we make payments and introduced new opportunities for financial inclusion. In regions where traditional banking services may be limited, mobile payment solutions have enabled individuals to access financial services and participate in the digital economy. This has empowered underserved populations and contributed to economic growth and development.

In all, mobile payment solutions have revolutionized the way we conduct financial transactions. By leveraging the power of mobile devices and innovative technologies, they offer convenience, security, and accessibility. These solutions have reshaped the digital economy. It is empowering businesses and individuals alike. As technology advances, mobile payment solutions are expected to play an even more significant role in shaping the future of financial transactions.

Defining Mobile Payment Solutions

Mobile payment solutions are known as mobile payments or mobile banking. It refers to the technology and services that enable individuals and businesses to make financial transactions using mobile devices. These solutions leverage the capabilities of Smartphones, tablets, or other portable electronic devices to facilitate secure and convenient payment processes.

At its core, mobile payment solutions allow users to perform various financial activities. That includes making purchases, transferring funds, paying bills, and managing their accounts. All are done from the convenience of their mobile devices. These solutions often involve integrating software applications, mobile wallets, and payment gateways. That enables users to access and interact with their financial accounts seamlessly.

The defining characteristic of mobile payment solutions is their ability to eliminate the need for traditional forms of payment like cash or physical credit cards. Instead, these solutions enable users to store their payment information digitally within their mobile devices. This can be achieved through mobile wallet applications or by linking their mobile devices to their existing bank accounts or credit/debit cards.

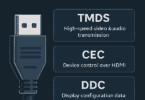

NFC

Mobile payment solutions employ various technologies to facilitate transactions securely and efficiently. One such technology is near-field communication (NFC). That allows users to make contactless payments by simply tapping their mobile devices on compatible payment terminals. NFC technology enables the seamless transfer of payment information between the mobile device and the terminal. It provides a convenient and swift payment experience.

Quick Response Code

Another common technology used in mobile payment solutions is the utilization of QR (Quick Response) codes. With QR codes, users can scan the codes presented by merchants or individuals to initiate payments. The scanned QR code contains relevant transaction information, like the recipient’s payment details and the transaction amount. It allows for quick and accurate transfers.

Mobile payment solutions also incorporate encryption and tokenization techniques to enhance security. Encryption ensures that sensitive data like payment card information. And the Payment card information is transmitted securely and cannot be intercepted or compromised. Tokenization replaces the actual payment card data with unique tokens. And that adds an extra layer of security by preventing the exposure of sensitive information during transactions.

It is important to note that mobile payment solutions are not limited to specific platforms or technologies. Various providers and services exist in the market. That includes mobile payment apps offered by financial institutions, third-party payment processors, and tech giants. Most of the popular mobile payment solutions are Apple Pay, Google Pay, Samsung Pay, PayPal, and Venmo.

Mobile payment solutions enable individuals and businesses to conduct financial transactions using their mobile devices. They leverage NFC, QR codes, and encryption technologies to provide secure, convenient, and contactless payment experiences. The adoption of Smartphones and advancements in digital payment technologies is growing. And the mobile payment solutions have become an integral part of modern-day commerce. They are transforming the way we make payments.

What is meant by Mobile Payment Solutions?

Mobile payment solutions encompass a range of technologies and services that facilitate secure and efficient financial transactions using mobile devices. They enable users to perform various payment activities like making purchases, transferring funds, and managing accounts. It is all through the convenience of their Smartphones or tablets.

At its core, mobile payment solutions integrate software applications, wallets, and payment gateways to establish a seamless connection between the user’s mobile device and the financial infrastructure. These solutions leverage mobile device’s computing power and connectivity to securely transmit payment information and authorize transactions.

Mobile payment solutions eliminate the need for traditional payment methods by digitizing payment credentials and storing them within the user’s mobile device. This can be achieved through mobile wallet applications. That securely stores payment card details or links directly to the user’s bank account. The mobile wallet acts as a virtual repository of payment information. And it enables users to make purchases by simply tapping their mobile device or scanning a QR code.

NFC

Near-field communication (NFC) technology is crucial in many mobile payment solutions. NFC enables contactless communication between the user’s mobile device and a compatible payment terminal in close proximity. The mobile device securely transmits the payment details to the terminal by initiating an NFC transaction. And that allows for swift and hassle-free transactions.

QR Code

Another technology utilized in mobile payment solutions is QR codes. Merchants generate unique QR codes containing payment information like the transaction amount and recipient details. Users can scan these codes using their mobile devices. It triggers the payment process. The scanned QR code serves as a medium for transmitting the necessary payment details. It ensures accurate and secure transactions.

Security is a paramount concern in mobile payment solutions. Encryption mechanisms are employed to safeguard sensitive payment data during transmission. Robust encryption algorithms ensure that the payment information remains encrypted while in transit. The encryption prevents unauthorized access or interception. Additionally, tokenization techniques are employed to replace sensitive payment card information with unique tokens. These tokens, used for transaction processing, are meaningless to potential attackers, further enhancing security.

Payment Solution

Various providers offer mobile payment solutions. That includes financial institutions, payment processors, and technology companies. These providers develop dedicated mobile applications or integrate their services with existing mobile wallet platforms. Users can choose from a range of options like Apple Pay, Google Pay, Samsung Pay, PayPal, and Venmo, depending on their device compatibility and preferred service provider.

Mobile payment solutions leverage mobile devices and advanced technologies to enable secure and efficient financial transactions. These solutions streamline payment processes and enhance convenience by integrating mobile wallets, NFC, QR codes, and encryption mechanisms. And it offers users an alternative to traditional payment methods. With continuous advancements in mobile technology, mobile payment solutions are poised to revolutionize further how we conduct transactions and shape the future of digital payments.

Importance and Impact of Mobile Payment Solutions on the Digital Economy

Mobile payment solutions have emerged as a significant catalyst for growth and innovation within the digital economy. The advent of these solutions has transformed the way individuals and businesses engage in financial transactions. It provides a multitude of benefits and drives substantial economic impact. Let’s explore the importance and impact of mobile payment solutions on the digital economy in more detail.

Increased Convenience and Accessibility

Mobile payment solutions offer unparalleled convenience to consumers. Individuals can make transactions anytime and anywhere by leveraging their smartphones or tablets. It eliminates the need to carry cash or physical payment cards. This convenience has resulted in increased customer satisfaction and enhanced user experiences. And that leads to higher engagement and repeat business. Moreover, mobile payment solutions have extended financial access to previously underserved populations. It enables individuals without traditional banking services to participate in the digital economy.

Accelerated Growth of E-commerce

Mobile payment solutions have played a pivotal role in driving the exponential growth of e-commerce. With the rise of online shopping, consumers increasingly demand secure and convenient payment options. Mobile payment solutions provide seamless integration with e-commerce platforms. It allows users to purchase with a few taps on their mobile devices. This streamlined checkout process has reduced friction and cart abandonment rates. They are ultimately boosting online sales and fueling the expansion of the digital economy.

Enhanced Security Measures

Security is a critical factor in financial transactions. And mobile payment solutions have implemented robust security measures to protect user data and prevent fraud. Encryption technologies ensure the secure transmission of payment information. It safeguards sensitive data from unauthorized access. Additionally, features like biometric authentication (e.g., fingerprint or facial recognition) add an extra layer of security. It mitigates the risk of identity theft or unauthorized transactions. The enhanced security offered by mobile payment solutions has instilled trust among consumers. And that fosters widespread adoption and usage.

Boost to Small Businesses and Startups

Mobile payment solutions have empowered small businesses and startups by providing accessible, cost-effective payment options. Traditional payment systems often impose high fees and complex setups. That poses challenges for smaller ventures. Mobile payment solutions offer affordable and user-friendly alternatives. It enables businesses of all sizes to accept digital payments. This has leveled the playing field and opened up new market opportunities for emerging entrepreneurs. That results in increased competition and economic growth.

Data Analytics and Consumer Insights

Mobile payment solutions generate a wealth of data that can be harnessed for valuable insights. Transaction data, purchase patterns, and customer behavior give businesses a deeper understanding of their target audience. By analyzing this data, companies can make informed decisions regarding marketing strategies, product offerings, and customer relationship management. These insights drive personalized experiences and tailored promotions. In addition, it fosters customer loyalty and drives revenue growth.

Expansion of Cashless Economies

Mobile payment solutions have contributed significantly to the growth of cashless economies. By reducing reliance on physical cash, these solutions streamline transactions. And it reduces costs associated with cash handling. Further enhances overall efficiency. Cashless economies promote transparency. In addition, that reduces the risk of theft and improves financial inclusion by providing access to digital financial services. This transition to cashless transactions positively impacts the broader economy. And it facilitates economic development and promotes financial literacy.

Mobile payment solutions have become an integral part of the digital economy. It is revolutionizing the way individuals and businesses conduct financial transactions. And, it increased convenience and accelerated e-commerce growth. In addition, it enhanced security measures, support for small businesses, data analytics, and the promotion of cashless economies; these solutions have made a profound impact. As mobile technology advances, the importance and impact of mobile payment solutions are expected to expand further. Further. it drives innovation and shaping the future of the digital economy.

Evolution of Mobile Payments Solutions

The evolution of mobile payment solutions has witnessed a remarkable journey. It transforms the way we make financial transactions. Mobile payment solutions have continuously evolved from early systems to the current state of affairs. It incorporates new technologies and addresses changing consumer needs. Let’s explore the key milestones in the evolution of mobile payment solutions.

Early Systems and Technologies

The concept of mobile payments traces back to the late 1990s and early 2000s. During that time, the first attempts were made to enable payments using mobile devices. Initially, mobile payment systems relied on SMS (Short Message Service) technology. And that allowed users to make small purchases by sending premium-rate text messages. However, these systems had limitations like low transaction limits and security concerns.

Introduction of Mobile Wallets

The advent of Smartphones and mobile applications brought about significant advancements in mobile payment solutions. Mobile wallets, also known as digital wallets, emerged as a key innovation. These wallets allowed users to store payment card information securely on their mobile devices. By linking their bank accounts or credit/debit cards to mobile wallet apps, users could make payments by simply tapping their Smartphones or scanning QR codes.

Near Field Communication (NFC) Technology

The introduction of NFC technology revolutionized mobile payments by enabling secure and contactless transactions. NFC allows two devices in close proximity to establish a communication link. And that facilitates the exchange of payment information. This technology powers tap-and-go payments, where users can make purchases by waving their Smartphones or cards near compatible payment terminals. NFC-based mobile payment solutions like Apple Pay, Google Pay, and Samsung Pay gained widespread adoption and popularity.

Expansion of Mobile Payment Ecosystem

Mobile payment solutions expanded beyond physical point-of-sale transactions and began catering to online and in-app payments. E-commerce platforms and mobile apps integrated mobile payment options. And they provide users with a seamless checkout experience. This expansion fueled the growth of online shopping and transformed the way digital transactions are conducted.

Proliferation of QR Code Payments

QR code payments emerged as an alternative mobile payment method, particularly in regions with limited NFC infrastructure. QR codes are two-dimensional barcodes that store payment information. Users can scan these codes using their Smartphones, triggering the payment process. QR code payments gained popularity due to their compatibility across a wide range of devices and their ease of implementation for merchants.

Integration of Biometric Authentication

Mobile payment solutions started integrating biometric authentication methods to enhance security and user convenience. Technologies such as fingerprint recognition and facial recognition provide an additional layer of authentication. These Biometric authentications are replacing the need for traditional PINs or passwords. In addition, Biometric authentication adds an extra level of security. And it ensures that only authorized users can initiate transactions.

Integration of Loyalty and Rewards Programs

Mobile payment solutions have integrated loyalty and rewards programs. It enhances the overall payment experience for users. Users can seamlessly earn and redeem points by linking loyalty cards and rewards programs to mobile wallets. And they can receive personalized offers and enjoy a more engaging and convenient shopping experience.

Continued Innovation and Emerging Technologies

The evolution of mobile payment solutions is an ongoing process, with constant innovation and the emergence of new technologies. Blockchain technology and cryptocurrencies have started to make an impact in the mobile payment space. It offers decentralized and secure payment options. Additionally, advancements in wearable technology and the Internet of Things (IoT) have opened up possibilities for contactless payments through Smartwatches, fitness trackers, and connected devices.

The evolution of mobile payment solutions has witnessed a significant transformation from early SMS-based systems to the current era of mobile wallets, NFC payments, QR codes, and biometric authentication. These advancements have made mobile payments more secure, convenient, and accessible. And it is driving the growth of cashless economies and reshaping how we conduct financial transactions. With ongoing innovation and emerging technologies, the future of mobile payment solutions holds further potential for exciting developments and possibilities.

Early Systems and Technologies

During the early stages of mobile payment solutions, various systems and technologies were explored and implemented to enable financial transactions using mobile devices. The following are some notable early systems and technologies in the evolution of mobile payments.

SMS-based Payments

Mobile payments began with SMS technology in the late 1990s and early 2000s. Users could make small purchases by sending premium-rate text messages to the designated service provider. The purchase cost would be added to the user’s mobile phone bill or deducted from their prepaid balance. However, this method had limitations. The limitations are low transaction limits, lack of real-time confirmation, and security concerns.

Mobile Payment Stickers

To enable contactless payments, some early systems introduced mobile payment stickers. These were adhesive stickers with embedded payment chips that could be attached to the back of mobile phones. Users could tap their devices on compatible payment terminals to initiate transactions. However, this method required the user to have the sticker. And it was not widely adopted due to the inconvenience of applying and managing the stickers.

Wireless Application Protocol (WAP)

The introduction of WAP technology-enabled mobile devices to access the internet and interact with web-based payment systems. Users could make payments by accessing payment portals or mobile banking websites through the WAP browser on their mobile devices. However, this method had limitations in terms of usability and slow browsing speeds. And it has limited functionality compared to desktop experiences.

Mobile Carrier Billing

Another early system charged purchases directly to the user’s mobile phone bill. Users could purchase from mobile app stores, digital content providers, or online merchants. And the charges would be added to their monthly mobile phone bill or deducted from their prepaid balance. This method simplified the payment process, particularly for digital content purchases. But it was primarily limited to digital goods and services.

Early Mobile Wallets

The concept of mobile wallets started to emerge. And it allows users to store payment card information securely on their mobile devices. These early mobile wallets aimed to streamline the payment process by eliminating the need to carry physical cards. Users could make payments by presenting their mobile devices at compatible payment terminals or through online transactions. However, the adoption of mobile wallets was limited due to factors like limited device compatibility. Further, it needs standardized protocols and consumer trust concerns.

Early Mobile Banking

Financial institutions began offering mobile banking services allowing users to access their accounts and perform basic banking functions through mobile apps or web browsers. These services focused more on account management and fund transfers. But, they laid the foundation for future mobile payment solutions by establishing a secure and trusted mobile banking infrastructure.

These early systems and technologies laid the groundwork for the evolution of mobile payment solutions. And they paved the way for the advancements and innovations we see in today’s mobile payment landscape. While they had their limitations, they played a crucial role in experimenting with different approaches and understanding the potential of mobile payments. The learning from these early systems has helped shape the development of more sophisticated and user-friendly mobile payment solutions that we have today.

Shift towards Mobile Wallets and NFC Technology

The shift towards mobile wallets and NFC (Near Field Communication) technology marked a significant milestone in the evolution of mobile payment solutions. This transition brought about advancements in convenience and security. Further, it provides seamless transaction experiences. Let’s explore how adopting mobile wallets and NFC technology reshaped the mobile payment landscape.

- Mobile Wallets: Mobile wallets are also known as digital wallets or e-wallets. They revolutionized the way people make payments using their mobile devices. Mobile wallets are applications that securely store payment card details, loyalty cards, and other payment credentials on a user’s Smartphone or other mobile devices. Some popular mobile wallet platforms include Apple Pay, Google Pay, Samsung Pay, and PayPal.

Benefits of Mobile Wallets:

- Convenience: Mobile wallets eliminate the need to carry physical cards. Users can simply tap their mobile devices or scan QR codes to initiate transactions, making payments quicker and more convenient.

- Secure Storage: Mobile wallets employ advanced security measures to protect sensitive payment information. Encryption techniques and tokenization are utilized to secure transactions and prevent unauthorized access.

- Multiple Payment Options: Mobile wallets provide users with the flexibility to link various payment methods, like credit cards, debit cards, bank accounts, or digital wallets, to a single platform. Further, it offers a diverse range of payment options.

- Enhanced Loyalty and Rewards Integration: Mobile wallets often incorporate loyalty and rewards programs. And it enables users to earn and redeem points and receive personalized offers. Further, you can enjoy a more seamless shopping experience.

- Near Field Communication (NFC) Technology: NFC technology facilitates secure and contactless transactions within the mobile payment ecosystem. NFC enables the communication between two devices in close proximity (usually within a few centimeters) by simply tapping or bringing them close together.

Benefits of NFC Technology:

- Contactless Payments: NFC technology allows users to make contactless payments by waving or tapping their mobile devices near compatible NFC-enabled payment terminals. This eliminates the need to swipe or insert payment cards physically. And it is making transactions faster and more convenient.

- Enhanced Security: NFC technology employs encryption to secure payment information during transmission. And it reduces the risk of data interception or theft. Additionally, NFC transactions require proximity. And that is minimizing the chances of unauthorized access.

- Versatility: NFC technology is not limited to payment transactions. It can be utilized for various applications like access control, public transportation ticketing, loyalty program integration, etc.

The adoption of mobile wallets and NFC technology revolutionized the mobile payment landscape. It is offering users a seamless, secure, and convenient payment experience. It eliminated the reliance on physical cards. And it is a platform for integrating multiple payment methods and loyalty programs. The proliferation of NFC-enabled payment terminals in retail stores and other establishments further accelerated the acceptance and usage of mobile payments. Today, mobile wallets and NFC technology continue to play a vital role in shaping the future of mobile payment solutions with ongoing advancements and innovations.

Current State of Mobile Payments Solutions

The current state of mobile payment solutions reflects a dynamic and rapidly evolving landscape. Advancements in technology drive it. Further, it is changing consumer preferences. In addition, it is changing the ongoing digital transformation. Here are some primary aspects that define the current state of mobile payment solutions.

Wide Adoption and Increasing Usage

Mobile payment solutions have experienced widespread adoption across various regions worldwide. Consumers have embraced the convenience and benefits offered by mobile payments. And it is leading to an increase in usage. Mobile payment apps and digital wallets provided by major technology companies, financial institutions, and third-party providers. They are now commonly used for a wide range of transactions like retail purchases, online shopping, bill payments, peer-to-peer transfers, and more.

Diverse Payment Methods and Technologies

The current mobile payment landscape offers a diverse range of payment methods and technologies. Users can make mobile payments using various options. Those options are NFC-based contactless payments, QR code payments, in-app purchases, mobile carrier billing, peer-to-peer payment apps, and more. This diversity enables users to choose the payment method that best suits their needs and the availability of compatible infrastructure in their region.

Integration with Online and Offline Merchants

Mobile payment solutions have established strong integration with both online and offline merchants. E-commerce platforms widely accept mobile payments. And that makes it seamless for consumers to make purchases through mobile apps or mobile web browsers. Mobile payment acceptance has become widespread in physical retail environments, with businesses adopting NFC-enabled payment terminals and supporting contactless payment methods. Additionally, mobile payment solutions often offer features like loyalty program integration. Further, it enables users to earn rewards and redeem offers at participating merchants.

Enhanced Security Measures

Security remains a top priority for mobile payment solutions. Providers have implemented advanced security measures to protect user data. That includes encryption, tokenization, and multifactor authentication. Biometric authentication methods, like fingerprint recognition and facial recognition, add an extra layer of security. And it ensures that only authorized users can initiate transactions. Continuous efforts are being made to enhance security and build trust among users and merchants.

Integration of Value-added Services

Mobile payment solutions are expanding beyond basic payment functionality and integrating value-added services. For example, some mobile payment apps offer personal finance management tools, budgeting features, expense tracking, and financial insights. Integration with other services like ride-hailing, food delivery, and ticketing further enhances the convenience and utility of mobile payment solutions. In addition, it is creating a comprehensive ecosystem for users.

Focus on International and Cross-border Payments

Mobile payment solutions are increasingly facilitating international and cross-border transactions. Some mobile payment apps offer features like currency conversion. And it allows users to make payments in different currencies seamlessly. This has made it more convenient for travelers and businesses engaged in global commerce to transact digitally. And it is reducing the reliance on traditional payment methods.

Ongoing Innovation and Emerging Technologies

The mobile payment landscape continues to witness ongoing innovation and the emergence of new technologies. For example, blockchain technology and cryptocurrencies are being explored for secure, decentralized mobile payment solutions. Wearable devices like Smartwatches are becoming integrated with mobile payment capabilities. And that allows users to make payments directly from their wrists. Artificial intelligence and machine learning are being leveraged to enhance fraud detection and provide personalized payment experiences.

So, the current state of mobile payment solutions showcases a thriving ecosystem with wide adoption of diverse payment methods. In addition, it enhanced security, integration with merchants, and a focus on convenience and value-added services. As technology advances and consumer expectations evolve, the future of mobile payment solutions will likely witness further innovation and transformative developments. It is shaping the way we transact and interact with digital finance.

Key Technologies Driving Mobile Payments

Mobile payments have been empowered by several key technologies that have shaped and driven their development. These technologies have enabled secure, convenient, and seamless transactions through mobile devices. Here are some key technologies driving mobile payments.

Near Field Communication (NFC)

NFC technology enables contactless communication between two devices when they are in close proximity (typically a few centimeters). In addition, NFC has revolutionized mobile payments by allowing users to make secure and convenient tap-and-go transactions simply by waving or tapping their Smartphones or smart cards near NFC-enabled payment terminals. Further, NFC technology ensures encrypted communication. And it reduces the risk of data interception or theft.

Secure Element (SE) and Host Card Emulation (HCE)

Secure Element refers to a tamper-resistant hardware component within a mobile device that securely stores sensitive payment information like credit card details. This technology ensures the secure storage and processing of payment credentials. SE is protecting them from unauthorized access. On the other hand, Host Card Emulation allows mobile devices to emulate the functionality of a physical payment card without needing a dedicated Secure Element. HCE enables mobile payments by securely storing payment information in software form. It enhances flexibility and interoperability.

Biometric Authentication

Biometric authentication technologies, like fingerprint recognition and facial recognition, have significantly enhanced the security and convenience of mobile payments. By utilizing the unique physical characteristics of individuals, biometric authentication provides an additional layer of security. And it is replacing or supplementing traditional PINs or passwords. Biometric authentication methods are increasingly integrated into mobile payment solutions. It ensures that only authorized users can initiate transactions.

QR Codes

Quick Response (QR) codes have gained prominence in mobile payment solutions, particularly in regions with limited NFC infrastructure. QR codes are two-dimensional barcodes that store payment information. Users can scan these codes using their mobile devices. And that will trigger the payment process. QR code-based mobile payments are versatile, as they can be used with any Smartphone equipped with a camera and a QR code scanning app. QR codes are cost-effective and easy to implement. And it offers compatibility across a wide range of devices.

Tokenization

Tokenization is a security measure that replaces sensitive payment card information with a unique token. When a mobile payment is initiated, the token is used in place of the actual card details. It reduces the risk of exposing sensitive information. Tokenization ensures that even if the token is intercepted or compromised, it cannot be used to perform fraudulent transactions. This technology adds an extra layer of security to mobile payments. And that is bolstering consumer confidence.

Mobile Wallet Applications

Mobile wallet applications serve as the central hub for securely storing payment card information, loyalty cards, and other payment credentials on mobile devices. These applications leverage various technologies and encryption methods to protect sensitive data. Further, these applications facilitate seamless transactions. Mobile wallet apps provide users with a unified platform to manage their payment methods. And it allows the users to make purchases in physical and online stores, send money to peers, and access value-added services.

Mobile Network Infrastructure

The advancements in mobile network infrastructure, particularly the widespread availability of high-speed mobile data networks (such as 4G and 5G). And it has played a crucial role in enabling mobile payments. These networks ensure fast and reliable connectivity. Further, it facilitates real-time authorization and transaction processing. Additionally, mobile network operators collaborate with financial institutions and mobile payment providers. And they offer services like mobile carrier billing, where payments are charged directly to the user’s mobile phone bill.

These key technologies have significantly transformed the landscape of mobile payments. It enables secure, convenient, and innovative transaction experiences. As technology advances, we can expect further enhancements and the emergence of new technologies that will shape the future of mobile payment solutions.

Near Field Communication (NFC)

Near Field Communication is a wireless communication technology that enables short-range communication between devices when they are in close proximity (typically within a few centimeters). NFC technology allows for secure and contactless data exchange between two NFC-enabled devices or between an NFC device and an NFC reader.

Here are some key aspects of NFC technology:

Communication Mode

NFC operates in two modes active mode and passive mode. Both devices generate their own radio frequency fields in active mode and can send and receive data. In passive mode, one device generates the RF field, while the other device only receives data. Most mobile devices like Smartphones and Tablets support both active and passive modes.

Contactless Data Transfer

NFC facilitates contactless data transfer by using electromagnetic induction to establish a connection between devices. When two NFC-enabled devices are brought close together, they establish a communication link. And that allows for the exchange of information. This contactless nature makes NFC suitable for various applications like mobile payments, ticketing, access control, data sharing, and more.

Peer-to-Peer Communication

NFC enables peer-to-peer communication. And the Peer to Peer communication allows two NFC devices to exchange data directly without the need for an intermediary like a network or internet connection. This feature is handy for applications like file sharing, contact information exchange, or initiating mobile payments between two Smartphones.

Security and Encryption

NFC technology incorporates security measures to ensure the privacy and integrity of data exchanged between devices. Encryption techniques are employed to protect sensitive information during communication. Security and encryption reduce the risk of data interception or tampering. Additionally, NFC transactions require close proximity. And that adds an extra layer of security as physical proximity is necessary to establish a connection.

Compatibility and Interoperability

NFC technology is compatible with a wide range of devices and infrastructure. Many Smartphones, Tablets, and wearable devices come with built-in NFC capabilities. NFC readers and terminals are also prevalent in various environments like retail stores, public transportation systems, and access control systems. The interoperability of NFC ensures seamless communication between different devices and enables the widespread adoption of NFC-based services.

Use Cases

NFC technology has found applications in various domains. Mobile payments are one of the prominent use cases, where users can make secure contactless payments by tapping their NFC-enabled Smartphones or smart cards on compatible payment terminals. NFC is also used for ticketing in public transportation systems. Further, NFC allows users to access and validates their tickets conveniently. Additionally, NFC is utilized for information sharing, like sharing contact details, pairing Bluetooth devices, or retrieving information from NFC tags embedded in physical objects.

NFC has played a significant role in adopting mobile payments and contactless transactions. Its convenience, security, and compatibility make it an ideal technology for various applications beyond payments. As NFC technology evolves, we expect to see further integration and innovation in mobile payment solutions and other NFC-enabled services.

QR Codes and Scan-to-Pay Technology

QR codes and Scan-to-Pay technology have emerged as popular methods for facilitating mobile payments and seamless transactions. Let’s explore how QR codes and Scan-to-Pay technology work and impact mobile payment solutions.

-

QR Codes:

QR (Quick Response) codes are two-dimensional barcodes that can store significant information. They consist of black squares arranged on a white background and can be easily scanned by a Smartphone camera or a dedicated QR code reader. QR codes can store various data types like payment information, website URLs, contact details, etc.

In the context of mobile payments,

QR codes are utilized in the following ways:

- Payment Initiation: Merchants generate a unique QR code containing payment details like the transaction amount and recipient information. Customers can scan this QR code using their mobile payment app, which triggers the payment process.

- Payment Confirmation: Customers can also generate their own QR codes containing their payment information, which merchants can scan to complete the transaction. This method is often used in peer-to-peer payments or scenarios where customers provide their payment information directly.

- Scan-to-Pay Technology: Scan-to-Pay technology refers to the process of scanning a QR code to initiate payment directly from a mobile device. It simplifies the payment process by eliminating the need for physical cards or manual payment details entry. Here’s how Scan-to-Pay technology typically works:

- Customer Experience: Customers open their mobile payment app or wallet and select the Scan-to-Pay option. They then scan the QR code the merchant or recipient displays using the Smartphone’s camera. The payment app reads the encoded information from the QR code and securely processes the payment.

- Payment Authorization: Upon scanning the QR code, the mobile payment app prompts the customer to verify and authorize the payment. This step typically involves confirming the transaction amount and selecting the desired payment method (e.g., linked credit card, bank account). Further, it also provides additional authentication factors like biometric verification or PIN entry.

- Payment Confirmation: Once the payment is authorized, the mobile payment app securely transmits the payment details to the recipient or merchant. The transaction is completed, and both parties receive confirmation of the successful payment.

Benefits of QR Codes and Scan-to-Pay Technology:

- Convenience: QR codes simplify the payment process by enabling users to initiate transactions with a simple scan using their mobile devices. It eliminates the need for physical cards or manual entry of payment details. It is streamlining the payment experience.

- Wide Compatibility: QR codes can be scanned by any Smartphone equipped with a camera and a QR code scanning app. This compatibility makes QR codes a versatile and accessible technology for mobile payments across different devices and platforms.

- Security: QR codes can incorporate encryption and tokenization techniques to ensure the secure transmission of payment information. Additionally, the customer retains control over the scanning process. It minimizes the risk of unauthorized transactions.

- Cost-effectiveness: QR codes can be easily generated and displayed by merchants without the need for expensive hardware or specialized infrastructure. This makes it an affordable option for businesses of all sizes to accept mobile payments.

- Integration and Innovation: QR codes can be integrated with various systems like point-of-sale (POS) systems, e-commerce platforms, and loyalty programs. This integration allows seamless and personalized payment experiences, loyalty point accumulation, and targeted marketing opportunities.

QR codes and Scan-to-Pay technology have gained significant traction in mobile payment solutions due to their simplicity, convenience, and versatility. Technology continues to evolve. Therefore, we can expect further innovations and integration in mobile payments. And that will provide users with even more seamless and secure transaction experiences.

Mobile Wallets and Digital Payment Apps

Mobile wallets and digital payment apps have revolutionized how we make payments. It enables users to securely store payment credentials and conduct transactions using their mobile devices. These applications provide a convenient and seamless payment experience. It eliminates the need for physical cards or cash.

Let’s explore mobile wallets and digital payment apps in more detail:

-

Mobile Wallets:

Mobile wallets are applications that allow users to store various types of payment credentials like credit or debit card information, bank account details, and digital currencies, securely on their mobile devices. These wallets act as a digital representation of traditional physical wallets. It provides a centralized and secure location for storing payment information. Some key features and benefits of mobile wallets include:

-

Secure Storage:

Mobile wallets employ robust encryption techniques and security measures to protect sensitive payment information. User data is encrypted and stored securely on the device or in a cloud-based vault. And that ensures the privacy and integrity of the stored credentials.

-

Payment Convenience:

Mobile wallets provide a streamlined payment experience by eliminating the need to carry physical cards or cash. Users can simply open the mobile wallet app, select the desired payment method, and complete transactions by tapping, scanning QR codes, or using other supported payment methods.

-

Wide Acceptance:

Mobile wallets are widely accepted by online and offline merchants. They can be used for various transactions like retail purchases, in-app purchases, bill payments, peer-to-peer transfers, and more. Mobile wallets often support NFC technology. And the NFC technology allows users to make contactless payments by tapping their devices on compatible payment terminals.

-

Loyalty and Rewards Integration:

Many mobile wallet applications offer integration with loyalty programs. And they enable users to earn rewards, store digital coupons, and redeem offers seamlessly during the payment process. This integration enhances the user experience and provides additional value to customers.

-

Financial Management Tools:

Some mobile wallet apps offer additional features like expense tracking, budgeting tools, and financial insights. These tools help users manage their finances, track their spending, and gain insights into their payment habits. And financial management tools promote financial wellness.

-

Digital Payment Apps:

Digital payment apps are specialized applications that focus primarily on facilitating payments and transactions. These apps may offer features beyond traditional mobile wallets, like peer-to-peer money transfers, in-app payments, split bills, and integration with various services and platforms. Some popular digital payment apps include PayPal, Venmo, Google Pay, Apple Pay, Alipay, and WeChat Pay. Key features of digital payment apps include:

-

Peer-to-Peer Payments:

Digital payment apps often provide a convenient way to send and receive money directly between individuals. Users can initiate payments by entering the recipient’s contact information. They can scan a QR code or select the recipient from their contact list.

-

In-App Payments:

Digital payment apps are often integrated with other apps and platforms. They allow users to make payments within those apps seamlessly. For example, users can pay for goods and services directly from e-commerce apps or make in-app purchases in games and other digital platforms.

-

Cross-Border Payments:

Some digital payment apps facilitate cross-border payments. And that enables users to send money internationally with ease. These apps may support currency conversion. And they provide competitive exchange rates and offer convenient ways to transfer funds across different countries.

-

Payment Request and Split Bills:

Digital payment apps allow users to request payments from others. And this feature makes it convenient for splitting bills, sharing expenses, or collecting payments for goods and services. This feature simplifies the process of dividing costs among friends, colleagues, or groups.

-

Integration with Other Services:

Digital payment apps often integrate with ride-hailing apps, food delivery platforms, and ticketing services. This integration allows users to make payments seamlessly within these services, enhancing the overall user experience.

Mobile wallets and digital payment apps have transformed the way we handle transactions. And they offer convenience, security, and a range of additional features. With their widespread adoption and ongoing advancements, these applications continue to shape the future of digital payments. In addition, they can provide users with more seamless, secure, and innovative ways to manage their finances.

Benefits of Mobile Payment Solutions

Mobile payment solutions offer a wide range of benefits. That has transformed the way we make transactions and handle finances. Here are some key advantages of using mobile payment solutions.

Convenience

Mobile payments provide unparalleled convenience for users. With mobile payment apps or mobile wallets installed on their Smartphones, users can make payments anytime, anywhere, as long as they have an internet connection. There’s no need to carry physical wallets, search for cash, or swipe cards. The ease of completing transactions with just a few taps on a mobile device makes mobile payments a preferred choice for many.

Security

Mobile payment solutions prioritize security to protect users’ financial information. They employ robust encryption techniques, tokenization, and secure authentication methods to safeguard sensitive data. Additionally, mobile payment apps often require additional authentication factors like biometric verification (fingerprint or facial recognition) or PIN entry. It adds an extra layer of security. Compared to traditional payment methods, mobile payments offer enhanced security and reduce the risk of card skimming or theft.

Speed and Efficiency

Mobile payments are fast and efficient. With contactless payment technologies like NFC or scan-to-pay, transactions can be completed within seconds. This streamlined process saves time for both customers and merchants. It is especially in high-traffic environments like retail stores or public transportation systems. Mobile payments eliminate the need for manual entry of payment information. It reduces potential errors and speeds up the checkout process.

Integration with Loyalty Programs

Many mobile payment solutions integrate with loyalty programs and rewards systems. Users can conveniently accumulate and redeem loyalty points. Users can access personalized offers and discounts and receive digital coupons directly within the mobile payment app. This integration enhances the overall customer experience and provides additional value to users.

Enhanced Financial Management

Mobile payment solutions often include features that help users manage their finances more effectively. They may provide transaction histories, spending analytics, and budgeting tools to track expenses and gain insights into spending patterns. These features give users better control over their finances and allow them to make more informed financial decisions.

Contactless and Hygienic

Mobile payments offer a contactless payment option in today’s world, where health and hygiene have become paramount. Users can complete transactions without physically handing over cards or touching payment terminals. And that reduces the risk of germ transmission. This contactless nature of mobile payments promotes a safer and more hygienic payment experience.

Flexibility and Accessibility

Mobile payment solutions are compatible with many mobile devices, including Smartphones and tablets. They can be used across different operating systems. And this makes them accessible to a large user base. Additionally, mobile payments can be used for various transaction types. That includes retail purchases, online shopping, bill payments, peer-to-peer transfers, and more. This versatility and flexibility make mobile payments convenient for different payment scenarios.

Eco-Friendly

Mobile payments contribute to a greener environment by reducing the reliance on paper-based transactions. With digital receipts and electronic transactions, the need for paper receipts and invoices is minimized. And that results in less paper waste and environmental impact.

Overall, mobile payment solutions offer numerous benefits that enhance the payment experience for users. They improve security and streamline financial transactions. As technology advances, we can expect further innovations in mobile payments. Those can bring even more advantages and features to users.

Convenience and Ease of Use

One of the primary benefits of mobile payment solutions is their convenience and ease of use. Here’s a closer look at how mobile payments make transactions more convenient and user-friendly.

Quick and Effortless Transactions

Mobile payment solutions simplify the payment process. And they allow users to complete transactions quickly and effortlessly. With just a few taps on their Smartphones, users can initiate payments. And this feature eliminates the need to carry cash or dig through wallets to find the right card. This streamlined process saves time and reduces the hassle associated with traditional payment methods.

Anytime, Anywhere Payments

Mobile payments enable users to make transactions anytime and anywhere, as long as they have their mobile device and an internet connection. Whether they are shopping at a physical store, making online purchases, or transferring money to friends or family, mobile payment solutions provide the flexibility to conduct transactions on the go without being restricted by location or business hours.

Wide Acceptance

Merchants, both online and offline, widely accept mobile payment solutions. They can be used at various businesses like retail stores, restaurants, cafes, gas stations, and more. The growing adoption of contactless payment technologies like NFC or QR codes has further expanded the acceptance of mobile payments. It makes it easier for users to pay using their Smartphones.

Integration with Mobile Wallets

Mobile payment solutions often integrate with mobile wallets. And mobile wallets act as a digital repository for storing payment credentials. Mobile wallets consolidate multiple payment methods into a single app, like credit or debit cards, bank accounts, or digital wallets. This integration makes it convenient for users to access their preferred payment methods within the mobile payment app. They eliminate the need to carry multiple physical cards.

Seamless Online Shopping

Mobile payment solutions simplify the check-out process for online shopping. Users can quickly enter their payment details with stored payment information and autofill features. And this autofill feature reduces the time and effort required to complete online purchases. Some mobile payment solutions also offer one-click or one-touch payment options. And that allows users to make purchases with a single tap. Further, it enhances the convenience of online transactions.

P2P Transfers Made Easy

Mobile payment solutions often include peer-to-peer (P2P) transfer capabilities. It enables users to effortlessly send money to friends, family, or colleagues. P2P transfers can be initiated using contact lists, phone numbers, or email addresses. And it makes it simple to split bills, repay borrowed money, or send monetary gifts on special occasions.

Transaction History and Receipt Management

These typically provide users with access to transaction histories. It allows them to review past purchases and track their spending. This feature assists in budgeting, expense management, and financial planning. Additionally, digital receipts are often generated for mobile payments. And that is eliminating the need for paper receipts and simplifying record-keeping.

User-Friendly Interfaces

Mobile payment apps are designed with user-friendly interfaces. And it makes them intuitive and easy to navigate. They prioritize simplicity and provide clear instructions for users to follow during the payment process. This user-centric approach ensures that even individuals who are not tech-savvy can easily use mobile payment solutions.

Mobile payment solutions’ convenience and ease of use have made them increasingly popular among consumers. As technology advances and mobile payment solutions continue to evolve, we can expect even more seamless and user-friendly experiences. Further, it enhances the convenience of making transactions with mobile devices.

Enhanced Security Measures

Mobile payment solutions provide enhanced security measures to protect users’ financial information and ensure secure transactions. Here are some key security features and measures offered by mobile payment solutions.

Encryption

It use encryption techniques to secure sensitive data during transmission. Encryption converts payment information into an unreadable format. And that encryption ensures that the data cannot be deciphered even if intercepted without the proper encryption key. This protects users’ payment details from unauthorized access.

Tokenization

Tokenization is a security measure used in mobile payments to replace sensitive payment information with unique tokens. Instead of transmitting actual card details, a token is generated and used for transaction processing. Tokens are useless to hackers as they do not contain any valuable information. This adds an extra layer of security. And it minimizes the risk of card data theft.

Biometric Authentication

It incorporate biometric authentication methods such as fingerprint scanning or facial recognition. These biometric identifiers ensure that only authorized users can access and authorize transactions within the mobile payment app. Biometric authentication adds an extra layer of security beyond passwords or PINs, as these biometric features are unique to each individual.

Secure Element Technology

Mobile payment leverage secure element technology to store and protect sensitive payment credentials. Secure elements are dedicated hardware chips embedded within mobile devices like a Trusted Execution Environment (TEE) or a Secure Element (SE). These chips provide a secure, isolated environment for storing and processing payment data. And they are protecting it from unauthorized access or tampering.

Device Authentication

These employ device authentication techniques to ensure that transactions can only be initiated from trusted devices. Devices are verified using unique identifiers, certificates, or other authentication methods. The authentication prevents unauthorized access to payment accounts and transactions.

Transaction Monitoring and Fraud Detection

These solutions often employ advanced fraud detection algorithms and real-time transaction monitoring systems. These systems analyze transaction patterns. And they detect suspicious activities and notify users or financial institutions of potentially fraudulent transactions. This proactive approach helps prevent unauthorized transactions and enhances the overall security of mobile payments.

Remote Disabling and Find My Device

In the event of a lost or stolen device, mobile payment solutions often provide features like remote disabling or locking of payment capabilities. Users can remotely deactivate their payment accounts associated with the device to prevent unauthorized transactions. Features like “Find My Device” allow users to locate their lost or stolen devices. Further, it mitigates the risk of unauthorized access to mobile payment information.

Compliance with Security Standards

Mobile payment solutions adhere to industry security standards and regulations. Compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) ensures that the mobile payment solution meets stringent security requirements. And it follows best practices in handling payment data.

These enhanced security measures in mobile payment solutions aim to protect users’ financial information, prevent fraud, and ensure secure transactions. However, users also play a crucial role in maintaining security by keeping their devices. They need to keep their mobile payment apps up to date. They must use strong passwords or biometric authentication and be vigilant about their transactions. By combining robust security features with responsible user practices, mobile payment solutions offer a secure payment ecosystem for users.

Faster and Streamlined Transactions

They offer faster and more streamlined transactions. It provides users with a more efficient and convenient payment experience. Here are some ways mobile payment solutions contribute to faster and more streamlined transactions.

Contactless Payments

Mobile payment often support contactless payment technologies such as Near Field Communication (NFC) or Quick Response (QR) codes. These technologies enable users to make payments by simply tapping their mobile devices or scanning a QR code. It eliminates the need for physical cards or cash. Contactless payments are incredibly fast and reduce transaction time. It is especially in high-traffic environments like retail stores or transportation systems.

Quick Authorization

They facilitate quick authorization of transactions. With stored payment information and secure authentication methods, users can quickly confirm their identity and authorize transactions with a few taps on their mobile devices. This eliminates the need to enter payment details or lengthy authorization processes manually. It results in faster transaction times.

One-Click or One-Touch Payments

Many mobile payment offer one-click or one-touch payment options for seamless and expedited transactions. Once users have set up their preferred payment method and authentication preferences, subsequent transactions can be completed with a single click or touch. This streamlined process eliminates the need to re-enter payment details or go through multiple authorization steps, significantly reducing transaction time.

In-App Payments

Mobile payment often integrate with various apps and platforms. It enables in-app payments. This integration allows users to make payments directly within the app without switching between different applications or entering payment information repeatedly. For example, users can make purchases in e-commerce apps or pay for services within ride-hailing or food delivery apps, streamlining the entire payment process.

Seamless Online Shopping

Mobile payment simplify the check-out process for online shopping. With stored payment information and autofill features, users can quickly select their payment method and complete the purchase with minimal effort. This streamlined online shopping experience reduces cart abandonment rates and speeds up the transaction process. And it enhances overall efficiency.

Integration with Loyalty Programs and Coupons

Mobile payment often integrate loyalty programs and digital coupons. Further, it is streamlining transactions. Users can automatically apply loyalty rewards or redeem digital coupons during the payment process. It eliminates the need for separate steps or manual entry of discount codes. This integration saves time and ensures users can take advantage of benefits without additional effort.

Real-Time Transaction Processing

Mobile payment typically process transactions in real-time. Once payment is authorized, the transaction is processed and instantly reflected in the user’s account. This real-time processing eliminates the delays associated with traditional payment methods like waiting for checks to clear or manual processing of transactions.

Simplified Split Payments

Some mobile payment offer features that simplify split payments or shared expenses. Users can easily split bills or divide costs among multiple individuals within the payment app. This eliminates the need for manual calculations, separate payments, or complicated reimbursements. That results in a faster and more streamlined process.

Mobile payment significantly reduce transaction times by leveraging technology and optimizing the payment experience. It makes the payments faster, more efficient, and hassle-free. This benefits users and contributes to improved operational efficiency for businesses.

Integration with Loyalty and Rewards Programs

Integration with loyalty and rewards programs is a key feature of many mobile payment solutions. By combining payment functionality with loyalty programs, these solutions offer added value to users. And it enhances the overall customer experience. Here’s how integration with loyalty and rewards programs benefits mobile payment solutions.

Consolidation of Rewards

Mobile payment provide users with a centralized platform to manage payment transactions and loyalty programs. Users can link their loyalty program accounts or memberships to their mobile payment app. And they can consolidate their rewards in one place. This eliminates the need to carry multiple physical loyalty cards or remember various account details. And it is making it more convenient for users to access and utilize their rewards.

Seamless Accumulation and Redemption

Integration with loyalty programs allows users to accumulate and redeem rewards within the mobile payment app seamlessly. With each eligible transaction, users can earn loyalty points, cashback, or other rewards automatically. When redeeming rewards, users can easily view their available rewards balance and choose how they want to utilize them, whether through discounts, free products or services, or other redemption options.

Personalized Offers and Discounts

Mobile payment leverage user data and transaction history to offer personalized offers and discounts through loyalty programs. The app can provide targeted promotions based on users’ preferences, spending patterns, or purchase history. And it can tailor recommendations or exclusive deals. This personalization enhances the value of loyalty programs. Further, it provides users with relevant and customized offers matching their interests and preferences.

Digital Coupons and Vouchers

Mobile payment often include digital coupon and voucher functionalities. Users can access and store digital coupons or vouchers within the app. This feature eliminates the need for physical printouts or remembering specific codes. When making a purchase, users can conveniently apply their digital coupons or vouchers with a simple tap, automatically applying for the associated discounts or benefits.

Gamification and Engagement

Integration with loyalty programs in mobile payment solutions often incorporates gamification elements to enhance user engagement. Users may earn badges, levels, or achievements based on their transaction activities. It encourages them to participate in loyalty programs actively. This gamified approach increases user engagement, loyalty, and motivation to accumulate and utilize rewards.

Notification of Reward Opportunities

Mobile payment with loyalty program integration can send notifications to users regarding reward opportunities, special promotions, or limited-time offers. These notifications inform users about new rewards, expiration dates, or other relevant information. It ensures that they never miss out on potential benefits.

Enhanced Tracking and Analytics

Integration with loyalty programs provides valuable data and analytics for both users and businesses. Users can access transaction histories, track their rewards earnings, and gain insights into spending patterns. This information helps users better understand their purchasing behaviors and make informed decisions. On the business side, merchants can leverage loyalty program data to analyze customer behavior. It identifies trends and creates targeted marketing strategies.

Cross-Partner Benefits

Some mobile payment solutions enable cross-partner benefits within their loyalty programs. Users can earn or redeem rewards with the payment solution provider and partner merchants or businesses. This expands the scope of rewards and offers more opportunities for users to earn and utilize rewards across a wider network of participating establishments.

Integration with loyalty and rewards programs enhances the value proposition of mobile payment solutions by providing users with additional incentives, personalized offers, and a seamless rewards experience. It fosters customer loyalty. It increases engagement and strengthens the relationship between users and businesses.

Popular Mobile Payment Solutions in the Market

The mobile payment market is evolving rapidly, with various solutions competing to provide convenient and secure payment options. Some popular mobile payment solutions have gained significant traction in the market.

Apple Pay

Apple Pay is a mobile payment and digital wallet service offered by Apple. It is available on Apple devices such as iPhones, iPads, Apple Watches, and Mac computers. Users can add their credit or debit cards to the Apple Wallet and make payments securely using near-field communication (NFC) technology or in-app purchases. Apple Pay also supports person-to-person payments and integration with loyalty programs.

Google Pay

Google Pay is developed by Google. It allows users to make payments using their Android Smartphones, wearables, and web browsers. It offers a seamless payment experience by integrating with users’ existing Google accounts and payment methods. Google Pay supports NFC payments, in-app purchases, and online transactions. It also includes features like peer-to-peer transfers, loyalty program integration, and access to transit ticketing systems in select regions.

Samsung Pay

Samsung Pay is a mobile payment service offered by Samsung for its Galaxy Smartphones and Smartwatches. It supports both NFC-based transactions and Magnetic Secure Transmission (MST) technology. It allows users to make payments at traditional magnetic stripe card terminals. Samsung Pay offers a wide range of features. Those include loyalty program integration, in-app payments, and peer-to-peer transfers.

PayPal

PayPal is a popular online payment platform. That has expanded into the mobile payment space. It enables users to link their bank accounts, credit cards, or PayPal balance to make mobile payments through the PayPal app. PayPal supports both online and in-store transactions. It offers buyer and seller protection, and facilitates peer-to-peer transfers. A large number of online merchants accept it, and it can be used internationally. And PayPal charges a little more.

Venmo

Venmo, owned by PayPal, is a mobile payment app focused on peer-to-peer transactions. It allows users to send and receive money from friends, family, or contacts by linking their bank accounts or debit cards. Venmo’s social aspect enables users to share payments with others, add comments or emojis, and view friends’ payment activities. Venmo also supports limited in-app purchases and the ability to split bills.

Alipay

Alipay is a leading mobile payment platform in China developed by Ant Group (formerly an affiliate of Alibaba Group). It offers a wide range of payment options. That includes QR code payments, in-app purchases, and integration with various online and offline merchants. Alipay also provides features like money transfers, bill payments, and access to financial services like savings accounts and investments.

WeChat Pay

WeChat Pay is integrated into the WeChat messaging app. It is a popular mobile payment solution in China. It enables users to make payments through QR codes and in-app purchases. And it is integrated with partner merchants. WeChat Pay also offers additional features like person-to-person transfers, bill splitting, and access to a wide range of services within the WeChat ecosystem. That includes messaging, social networking, and more.

Paytm

Paytm is a mobile payment and e-commerce platform based in India. It allows users to add money to their Paytm wallets and make payments through QR codes, in-app purchases, or online transactions. Paytm offers services such as bill payments, mobile recharges, ticket bookings, and integration with various online and offline merchants. It has gained significant popularity in India. And it expanded its services to include financial products like banking and investments.

These are just a few examples of popular mobile payment solutions in the market. The choice of a mobile payment solution often depends on factors such as device compatibility, geographical availability, merchant acceptance, and user preferences. As the mobile payment landscape evolves, new solutions and innovations will likely emerge. And they can offer even more options for convenient and secure mobile payments.

Apple Pay

Apple Pay is a popular mobile payment and digital wallet service offered by Apple. It allows users to make secure payments using their Apple devices like iPhones, iPads, Apple Watches, and Mac computers.

Here are some key features and benefits of Apple Pay.

Easy Setup

Setting up Apple Pay is straightforward. Users can add their credit or debit cards to the Apple Wallet by simply taking a photo of the card or entering the card details manually. Apple Pay supports cards from major banks and financial institutions.

Contactless Payments

Apple Pay utilizes near-field communication (NFC) technology. It allows users to make contactless payments by simply holding their iPhone or Apple Watch near a compatible payment terminal. This enables quick and convenient transactions without swiping cards or entering PINs.

In-App Purchases

Apple Pay can be used for seamless and secure in-app purchases. With a single touch, users can complete purchases within supported apps without entering payment information or creating new accounts. This streamlines the check-out process and enhances the overall user experience.

Secure Authentication

Apple Pay incorporates multiple layers of security. Users can authorize payments using biometric authentication methods such as Face ID (facial recognition) or Touch ID (fingerprint recognition). These biometric features ensure that only the authorized user can initiate transactions, adding extra security.

Enhanced Privacy

Apple Pay is designed with privacy in mind. When a payment is made, Apple Pay does not store or transmit the actual card numbers to merchants or Apple’s servers. Instead, a unique device account number is generated and used for each transaction. This enhances security by preventing the exposure of sensitive card details.

Wallet Organization

The Apple Wallet provides users with a centralized place to store and organize their payment cards, boarding passes, event tickets, loyalty cards, and more. This eliminates the need to carry physical cards or search through wallets or purses, making it easy to access and manage important digital items.

Loyalty Program Integration

Apple Pay allows users to add their loyalty cards to the Wallets and automatically earn rewards or access discounts when making payments. This integration streamlines the loyalty program experience, as users can simply tap their device at the payment terminal to simultaneously make a payment and accrue loyalty points.

Global Acceptance

Apple Pay is widely accepted by a growing number of retailers, both online and offline. It is supported by millions of merchants worldwide, including popular chains, restaurants, apps, and websites. This broad acceptance makes it convenient for users to use Apple Pay for their everyday transactions.

Person-to-Person Payments

Apple Pay also enables person-to-person payments through the Messages app. Users can send money to friends or family members securely and easily using Apple Pay Cash, which is integrated into the Wallet. This feature simplifies splitting bills, repaying borrowed money, or sending monetary gifts.

Apple Pay continues to expand its features and partnerships. That makes it a convenient and secure mobile payment solution for Apple device users. Its integration with other Apple services and devices enhances the overall user experience and provides a seamless payment ecosystem.

Google Pay

Google Pay is a popular mobile payment platform developed by Google. It allows users to make secure and convenient payments using their Android Smartphones, wearables, and web browsers. Here are some key features and benefits of Google Pay:

Seamless Setup

Getting started with Google Pay is simple. Users can link their existing debit or credit cards to their Google Pay account by entering the card details or taking a photo of the card. Google Pay also supports integration with partner banks and payment providers. And it enables users to add cards directly from their banking apps.

Contactless Payments

Google Pay supports contactless payments using near-field communication (NFC) technology. Users can simply tap their Android device on a compatible payment terminal to make fast and convenient transactions. This eliminates the need to carry physical cards and speeds up the check-out process.

In-App Purchases

Google Pay allows users to make seamless and secure in-app purchases. Users can choose Google Pay as their payment method when shopping within supported apps and complete the transaction with just a few taps. This eliminates the need to enter payment information repeatedly and enhances the overall user experience.

Online Payments

Google Pay can be used for secure online payments on websites and apps. Users can select Google Pay as their payment option during check-out and authorize the transaction using their Google Pay credentials. This simplifies the online payment process. And it eliminates the need to enter card details or create new accounts.

Loyalty Program Integration